Run payroll in minutes.

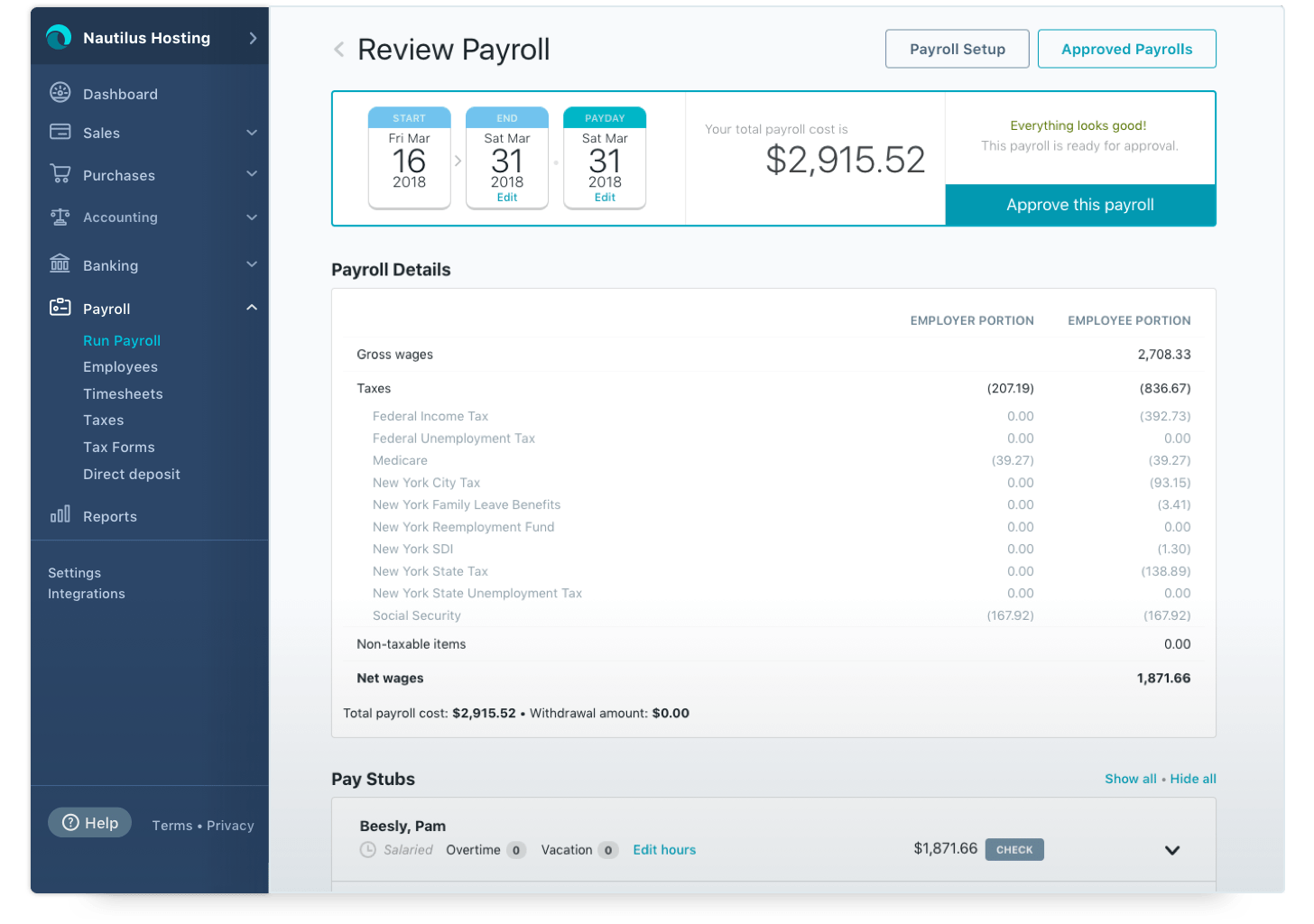

Approving payroll is as simple as two clicks.

100% guaranteed accuracy.

We ensure you meet government regulation and avoid penalties.

Only pay for what you need.

Pricing scales depending on your number of employees and usage.

Fast & Easy Setup

Payroll doesn’t have to be painful. Set up your account and start running payroll today. Coming from another payroll provider? Migrating your data is easy.

Vacations, Benefits and Bonuses

Lane Accounting handles vacations, bonuses and other benefit calculations, too, and provides accurate pay stubs and reports for you and your team.

Automatic Filings and Payments

In New York, California, Florida, Texas, Illinois and Washington, our complete payroll tax service can automatically pay and file your state and federal payroll taxes.

Payroll Journal Entries Automatically Recorded

Payroll by Lane Accounting connects seamlessly with the rest of your Wave account. Spend less time on manual bookkeeping and more time running your business.

Direct Deposit

No more running around with checks. Pay gets deposited right in your employees’ bank accounts, quickly and reliably. Less work for you, and your team will love it.

Employee Self-Service

Employees can log into our system securely to access their pay stubs and W2s, and manage their contact and banking information.